But Fannie and Freddie aren’t the only neglected housing institutions. The Federal Housing Finance Agency, or FHFA, the agency assigned to oversee the two institutions, had also been treated as somewhat of an orphan. It has operated since its enactment five years ago without a permanent director, in spite of its critical mission of providing oversight to two institutions that manage $5 trillion in mortgage debt.

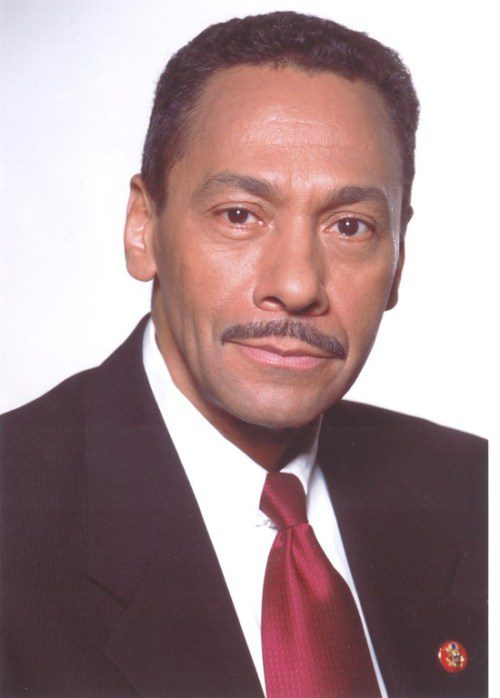

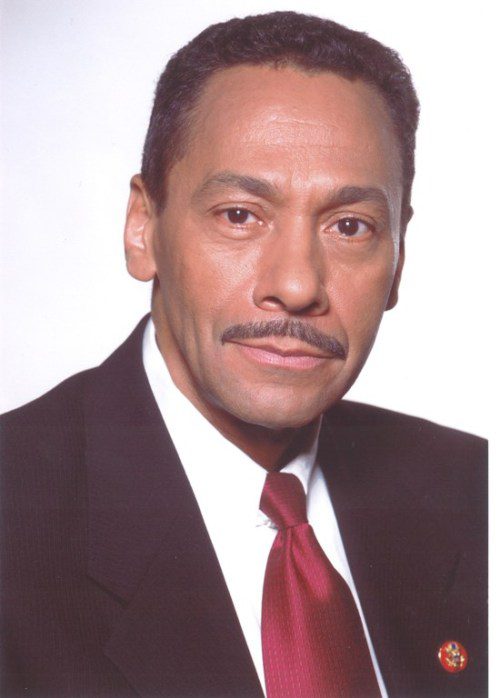

Congress’s recent approval of Congressman Mel Watt to lead the FHFA represents a potential turning point for housing finance reform. Since their dramatic collapse, Fannie and Freddie have returned to profitability and have now paid to the U.S. Treasury an amount of money approximately equal to the $188 billion in bailout funds that they received.

Yet, in spite of their record earnings, access to homeownership remains overly restricted. That’s because the mortgage finance industry has overcorrected for the lending abuses that occurred leading up to the crisis, now employing excessively rigid underwriting standards for 30 year fixed rate mortgages that exclude large numbers of qualified borrowers who could be successful homeowners.

One indicator of this trend is that, for the past two years, the majority of Fannie and Freddie’s business, more than 70 percent, has been the refinancing of existing loans rather than new loans to purchase a home. That development is neither healthy nor sustainable. The Mortgage Bankers Association recently estimated that mortgage originations for this year will likely fall relative to 2013 by nearly a third as refinancing activity wanes. As originations wither, so do the jobs and economic output associated with it.

And a failure to more substantially promote homeownership will translate into a long-term loss of wealth for our nation’s families.

First time homebuyers, including young adults, moderate-and lower-wealth households and borrowers of color are the most negatively harmed by needlessly restrictive underwriting practices. Mortgage loans to African Americans and Latinos, for example, are down by 73 percent and 66 percent respectively since 2005.

The trend is not only harmful, but also wrongheaded. Solidly underwritten, fully documented, low-downpayment, 30 year fixed rate mortgages were not the cause of the mortgage crisis. As a result, restricting their access serves no legitimate purpose.

Subprime loans were the epicenter of the foreclosure crisis. A major share of those products were designed to trigger an unaffordable interest rate payment increase that would force borrowers back to their lenders to refinance their loans to a lower interest rate. In the process, lenders could collect another round of unjustified high origination fees.

Whereas 30 year fixed mortgages have long been a steppingstone to economic opportunity for working families, subprime loans had little to do with expanding homeownership.

The Center for Responsible Lending has pointed out, only 9 percent of subprime loans were for first-time homeownership. The majority were part of the refinancing house of cards scheme that folded when home prices started heading south between 2006 and 2007.

Rather than unnecessarily denying access to the benefits of homeownership for millions of Americans, the FHFA should work with the Administration to achieve several major reforms as quickly as possible:

- Protect taxpayers from future losses by retaining some share of Fannie and Freddie earnings as a cushion against future losses;

- improve access to mortgage credit by keeping guarantee fees at the appropriate level sufficient solely to reserve for potential losses and operating expenses;

- work with lenders to increase credit access for low-downpayment borrowers and those with less-than-perfect credit scores;

- begin making contributions to the National Housing Trust Fund and Capital Magnet Funds as required by the Housing and Economic Recovery Act of 2008; and

- provide strong support to finance affordable rental housing.

For more than 60 years, homeownership has been a source of pride and self-esteem for the typical American family, as well as its most important source of wealth accumulation. Ensuring a firm foundation under such an important cornerstone of the American Dream should be the goal of all policymakers, regardless of their political views.

Comments